Very important to note :

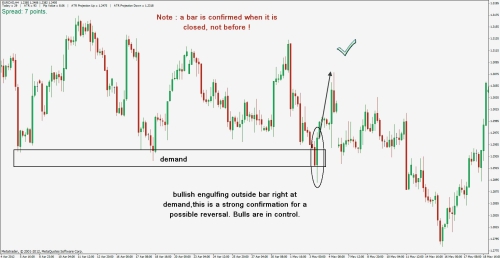

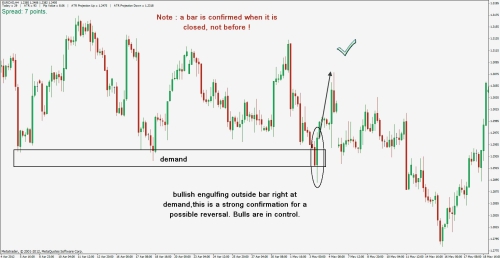

The basis of my strategy are supply and demand areas. Without any specific supply or demand area we dont need to check for further indicators.

If we have a supply or demand area we try to find some of the indicators mentioned in this article to increase our odds of a successful trade.

The more indicators provide our trading idea, the more likely our target will be hit..... logic ? Isn‘t it ?

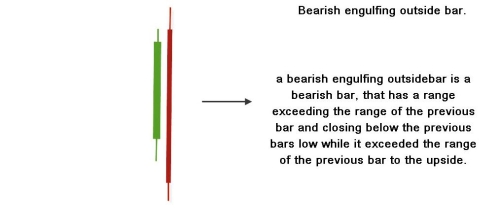

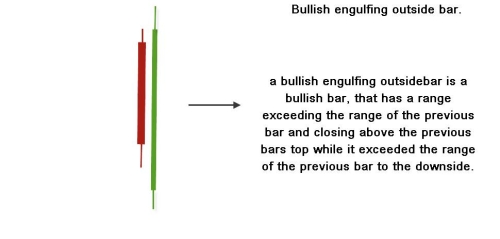

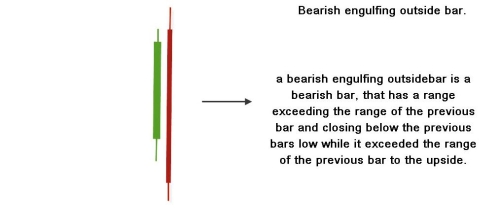

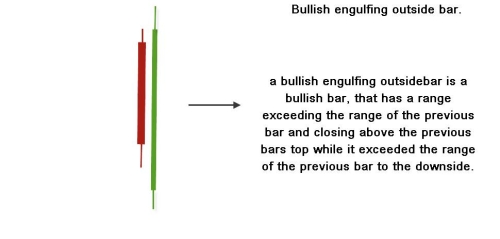

Bearish engulfing outside bar

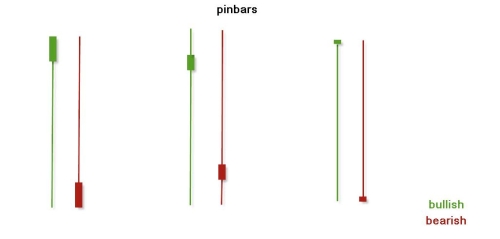

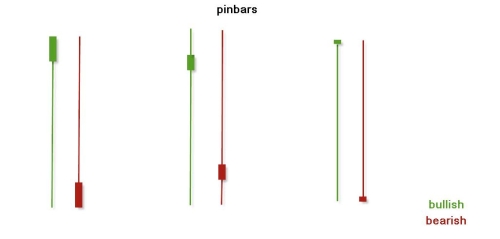

Pinbars

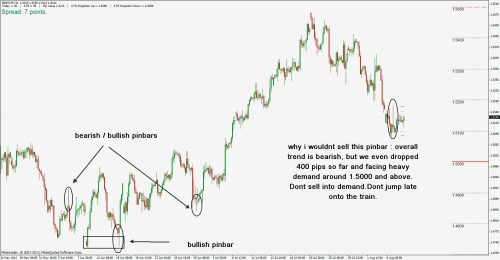

In my opinion the pinbar reversal pattern is one of the most powerful candlestick reversal patterns out there.

If you identify correctly and take the major ones they can produce consistently profits.

This single bar reversal pattern is able to earn a lot of cash for you.

And that‘s why most traders love it, because it is a single bar pattern, easy to spot, easy to trade.

Often pinbars develop at swing highs and lows, this is interesting if we combine it with demand and supply areas to catch the reversal points.

Again we can combine it with divergence of course to squeeze all odds out of it.

you can find my divergence course here in past articles called ( the power of divergence)

What is a pinbar at all ?

A pinbar is a candlestick pattern where the body of the candlestick is pretty small and the wick pretty long.

Again we do have two different types :

A bearish pinbar and a bullish pinbarA bullish pinbar is formed by a small body at the top and a large wick to the bottom, that indicates that price was sold down and bought back up again

within the same period of time.

To have a very strong bullish pinbar, the close is above the open and beow the open for bearish pinbar.

There are a lot of possible forms of the bar itself.

Sometimes the body differs from others, and so does the wick.

But all in all the longer the wick and the higher the close is away from the open the stronger our pinbar gets.

It is important to pick the pinbars that form at interesting areas for us.

at supply and demand areas we search for pinbars that develop next to or right at supply / demand areas.

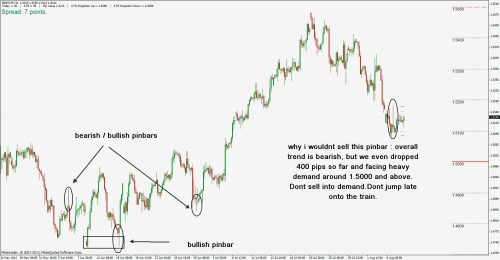

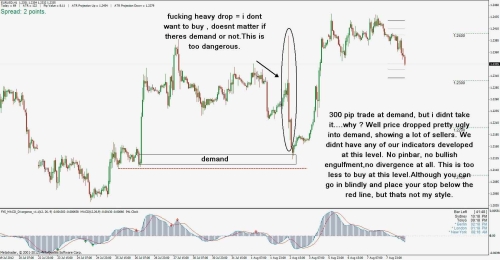

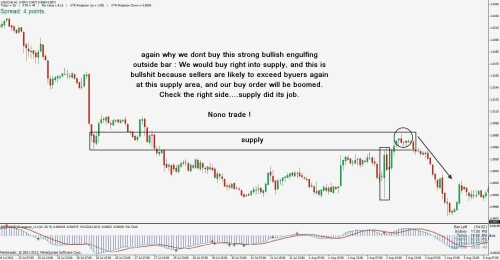

In the following examples i circled some pinbars for you,please note that not all of them are right at demand or supply areas.

This is just to show you how they can look like.

Usually we place the stop above/below the pinbar and aim for the next supply/demand area for a possible target

Now let the charts tell the story..... I dont want that you have to read too much, sorry for that ;)

Trading examples

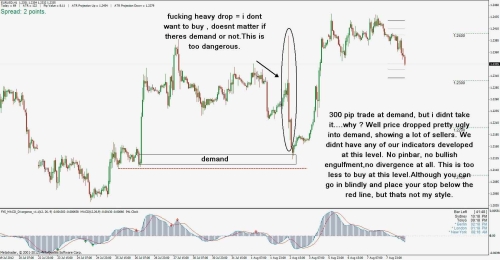

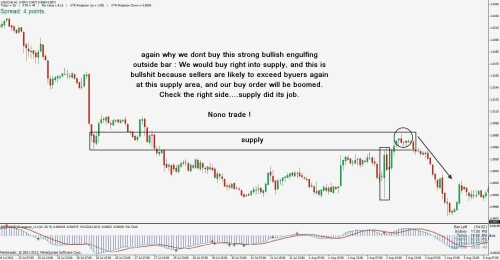

Alright, so again how do we start whenever we want to get a nice trade setup ?

1.) We open pair X and go to the monthly timeframe. I will take EURUSD for this parade example.

2.) There we search for the most important turning points // supply and demand areas and check whether the overall trend is bearish or bullish.

3.) We switch down to the weekly timeframe and repeat 2.) and search as well for a possible divergence here

4.) Guess what ? We now switch down to the daily and repeat step 3.)

5.) Then we wait for price to reach one of our demand/supply areas

6.) Price reached one of our supply/demand areas, now we search for price patterns,divergence, breakouts/retests to get a possible trade setup.

I will post a lot of examples of price reaching one of our demand/supply areas. Then we will go into deeper analysis to search for such indicators

offering us a trade.

Again : The EURUSD example just shows you how to begin with analysing a pair. We search for the major areas and wait for price to approach, then the

business starts.

I hope I was able to explain you how the markets move and how this business works at all.

I also hope that you can use parts of my strategy to improve your trading and change your trading style to increase your odds.

Again I want to mention that this is my style of trading and everyone should adapt his own style until he feels comfortable and satisfied whenever he enters a trade.

Build up your own rules, stick em on your screen, write them on a poster and hang it up at your toilet.

Follow a strict moneymanagement / riskmanagement concept, NEVER break your rules.

Psychology is a major part in trading, so become chosey und pick the very best trade setups.

please vote for me if it useful to u

thanks,

The basis of my strategy are supply and demand areas. Without any specific supply or demand area we dont need to check for further indicators.

If we have a supply or demand area we try to find some of the indicators mentioned in this article to increase our odds of a successful trade.

The more indicators provide our trading idea, the more likely our target will be hit..... logic ? Isn‘t it ?

Bearish engulfing outside bar

Pinbars

In my opinion the pinbar reversal pattern is one of the most powerful candlestick reversal patterns out there.

If you identify correctly and take the major ones they can produce consistently profits.

This single bar reversal pattern is able to earn a lot of cash for you.

And that‘s why most traders love it, because it is a single bar pattern, easy to spot, easy to trade.

Often pinbars develop at swing highs and lows, this is interesting if we combine it with demand and supply areas to catch the reversal points.

Again we can combine it with divergence of course to squeeze all odds out of it.

you can find my divergence course here in past articles called ( the power of divergence)

What is a pinbar at all ?

A pinbar is a candlestick pattern where the body of the candlestick is pretty small and the wick pretty long.

Again we do have two different types :

A bearish pinbar and a bullish pinbarA bullish pinbar is formed by a small body at the top and a large wick to the bottom, that indicates that price was sold down and bought back up again

within the same period of time.

To have a very strong bullish pinbar, the close is above the open and beow the open for bearish pinbar.

There are a lot of possible forms of the bar itself.

Sometimes the body differs from others, and so does the wick.

But all in all the longer the wick and the higher the close is away from the open the stronger our pinbar gets.

It is important to pick the pinbars that form at interesting areas for us.

at supply and demand areas we search for pinbars that develop next to or right at supply / demand areas.

In the following examples i circled some pinbars for you,please note that not all of them are right at demand or supply areas.

This is just to show you how they can look like.

Usually we place the stop above/below the pinbar and aim for the next supply/demand area for a possible target

Now let the charts tell the story..... I dont want that you have to read too much, sorry for that ;)

Trading examples

Alright, so again how do we start whenever we want to get a nice trade setup ?

1.) We open pair X and go to the monthly timeframe. I will take EURUSD for this parade example.

2.) There we search for the most important turning points // supply and demand areas and check whether the overall trend is bearish or bullish.

3.) We switch down to the weekly timeframe and repeat 2.) and search as well for a possible divergence here

4.) Guess what ? We now switch down to the daily and repeat step 3.)

5.) Then we wait for price to reach one of our demand/supply areas

6.) Price reached one of our supply/demand areas, now we search for price patterns,divergence, breakouts/retests to get a possible trade setup.

I will post a lot of examples of price reaching one of our demand/supply areas. Then we will go into deeper analysis to search for such indicators

offering us a trade.

Again : The EURUSD example just shows you how to begin with analysing a pair. We search for the major areas and wait for price to approach, then the

business starts.

I hope I was able to explain you how the markets move and how this business works at all.

I also hope that you can use parts of my strategy to improve your trading and change your trading style to increase your odds.

Again I want to mention that this is my style of trading and everyone should adapt his own style until he feels comfortable and satisfied whenever he enters a trade.

Build up your own rules, stick em on your screen, write them on a poster and hang it up at your toilet.

Follow a strict moneymanagement / riskmanagement concept, NEVER break your rules.

Psychology is a major part in trading, so become chosey und pick the very best trade setups.

please vote for me if it useful to u

thanks,

Mado

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.